This is the first of three posts that we recommend you read if you are new to currency exchange in France and usually check rates in currency converters on your mobile phone.

Foreign currency and travel money rates differ

One of the most common mistakes that users who travel make is to confuse currency exchange rates with those of paper currency. It’s not the same! And the fault of our confusion is the currency converters (Boursorama, Xe, Oanda, Cuex etc.).

The process of searching for an exchange rate looks something like this below. We want to know how much the dollar is, we go to Google, we type “euro dollar exchange” and we see several websites offering this info.

If you realize, in all these websites, which are called currency converters, they talk about “quotes” and “currencies”, but they don’t talk about the currency we use when abroad (travel money or holiday money).

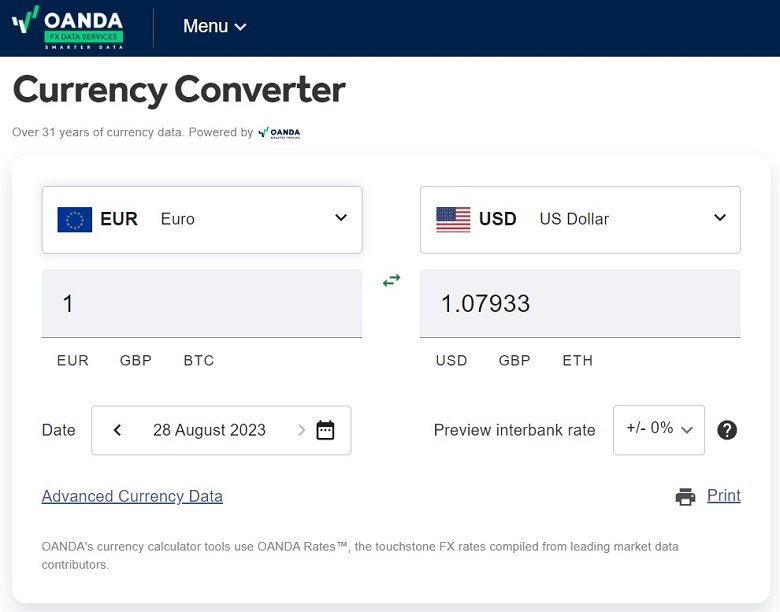

If you go into any currency converter (Xe, Oanda, Cuex, Boursorama, Coinmil), you will see that they are all similar.

They have a kind of “widget” where you select a foreign currency and they give you the exchange rate in real time, with respect to another currency (in France the euro).

It’s what they call “real-time market rates.” Something like that:

The phrase “real-time market rates” already warns you that this is the wholesale market (between banks and financial companies). And for more clarification, look at the text at the bottom of the image:

All figures are real-time mid-market exchange rates, which are not available to individual clients and are for reference only. To see the rates we quote for money transfers, use our transfer service.

And it would be necessary to add a “To see the rates that we quote for travel money”,… use a currency exchange comparator such as Comparer Devise.

If you pay attention, the euro to dollar exchange rates on any given day are different for currencies and for travel money.

For example:

- 1 EUR = 0.888745 USD (currency)

- 1 EUR = 0.84000 USD (banknotes)

This means that for 1,000 euros, 888,745 dollars are offered in the international (wholesale) currency market, and only 840 banknotes dollars at a currency supplier.

Therefore, what you see in a currency converter has nothing to do with the price at which a currency (in physical notes) is sold on average in a bank or currency supplier.

What are currencies

Currencies are the different official payment units of each country.

What is currency exchange

Foreign exchange is the set of currency purchase and sale transactions that banks and companies carry out with each other within their international operations.

These changes are made in the form of book entries, and do not require the physical movement of banknotes of one currency or another.

Wholesale currency exchange

It is a “virtual” market, in which the participating entities transfer balances between bank accounts expressed in different currencies (euro, pound, dollar, yen, etc.), applying an average market exchange rate to each transfer.

This type of exchange is said to be “wholesale” because it is designed for large companies and banks that make large movements of account balances among themselves.

Retail Currency Exchange

Nothing to do with retail currency exchange (money transfers between individuals to make payments abroad). And much less with the travel money currency exchange (physical notes) that we do when we travel abroad for pleasure or work.

What is currency exchange

Currency exchange is a commercial activity that requires the physical exchange of banknotes of one currency (euro, dollar, etc.) for notes of another currency (dollar, pound, euro, etc.).

It is usually done by banks and currency suppliers. These companies take the daily wholesale price of a currency pair (euro-dollar), and apply a profit margin to it.

Banks (and some currency suppliers) also apply a commission on the volume of money in euros that you exchange. For this reason, it is good to compare each day between the different companies that offer you foreign currency to see which is the most interesting.

Currency exchange rates

Depending on the people who exchange money, the currency exchange can be:

- Wholesaler (two currency suppliers exchange euros for dollars with each other) or,

- Retailer (an individual who exchanges currency at his bank or at a currency supplier).

The currency exchange can be of two types depending on the channel through which it is carried out:

- In-person (face to face): you make a payment in Euros in cash or with your credit card, in exchange for physical banknotes of another currency handed out to you.

- Distance selling: the desired currency is paid online, by transfer or card, or cash on delivery in euros, and in exchange the courier delivers the desired foreign currency at home or the office.

Depending on the type of currency exchange operation and with respect to the local currency:

- Purchase of foreign currency: the user pays X euros in exchange for Y dollars (pounds, yen, etc.).

- Sale of foreign currency: the user delivers foreign currency (dollars, pounds, yens, etc.) in exchange for euros.

Differences between foreign exchange and paper currency

Although colloquially we use currency and currencies interchangeably to refer to the same thing, it is important to clarify that:

- Foreign exchange is a movement of balances between bank accounts expressed in two different currencies.

- The prices of the wholesale foreign exchange market (between banks or companies) are quite tight.

- Currency exchange is the physical exchange of banknotes of one currency for nores of another, applying a currency exchange rate to the operation in which the parties agree.

- Travel money exchange rates between an individual and a bank or currency supplier include an exchange margin (and sometimes a fixed commission), which is why they are not as competitive as the exchange rates you see in currency converters.

Comparer Devise

Comparerdevise.fr is the first currency exchange comparator for travelers in France.

After our success in Spain and Portugal we have landed in France to introduce transparency in the French currency exchange market and to help you find the best rates every time you exchange money for your trips abroad.

Remember: currency converters show prices that you will not find in your bank or currency supplier.

Next recommended reading

This is the first of three posts that we recommend you read if you are new to currency exchange. The next one we advise you to read is “Where to change foreign currency in France“.

Sin comentarios