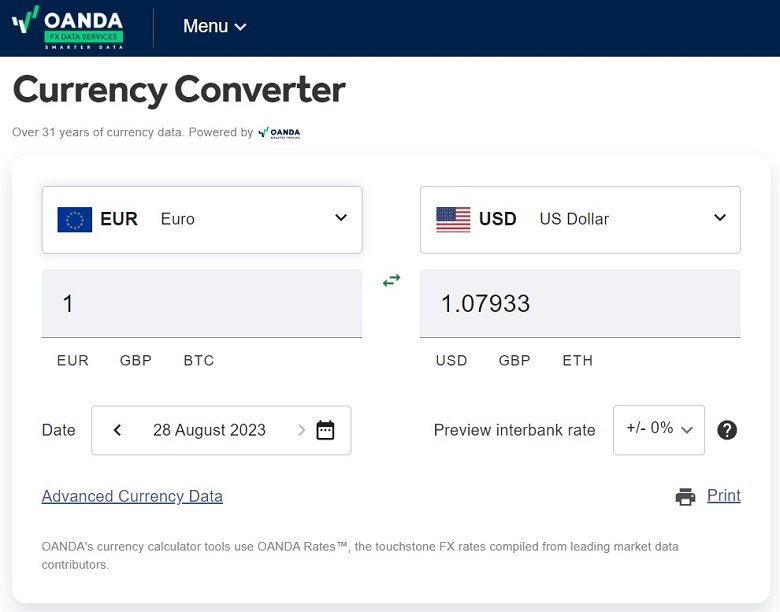

If you have ever searched the Internet with your mobile phone for an exchange rate of the euro against another currency, a currency converter with its exchange rate will have appeared among the first results (Oanda, XE, Coinmill, Insee, etc.). And you will have obtained a currency exchange rate.

However, you will soon realize that it is an exchange rate that is quite far from reality if you want to make an international transfer, send money or exchange currencies.

In this post we explain how the Oanda currency converter works in France and what precautions you have to take when you consult an exchange rate in these types of converters.

What is Oanda currency converter

Oanda is a currency converter. It is a tool that shows the exchange rates of a currency (in France, the Euro), with respect to other currencies in the world at all times (dollar, pound, yen, peso, etc.).

It also gives you the international price of precious metals or obsolete currencies (francs, marks, escudos, pesetas, etc). And it maintains a historical exchange rate data from January 1990.

This exchange rate “calculator” obtains the information of the rates of the foreign exchange market. This market, like that of any other product (gold, silver, cereals, oil, etc.) constantly sets a price for each good with respect to a currency (in this case, the euro).

The exchange rate, or exchange rate, is the price paid for a currency.

Direct and indirect exchange rate

In the case of currencies, the price is calculated by currency pairs (euro-dollar, euro-real, euro-pound sterling, etc.), one of them being the base currency.

But there is a particularity: the price of coins can be calculated in two directions, depending on the role played by the base currency:

-If I want to know the price of the dollar against the euro (how many dollars is worth a euro), I calculate the euro-dollar pair (direct exchange rate).

-If I want to know the price of the euro against the dollar (how many euros is worth a dollar), I calculate the dollar-euro pair (indirect exchange rate).

Where does the Oanda exchange rate come from currency converter

Now that you know a little more about currency exchange rates, where do Oanda and other currency comparators get their data?

In the case of Oanda, its explanatory page says the following:

Exchange rates provided by OANDA are global currency market averages compiled from frequently updated sources, including our currency trading platform OANDA fxTrade, leading market data providers, and contributing financial institutions.

Most of our rates are based on tens of thousands of different prices, collected at every tick, every second, 24 hours a day, 365 days a year.

Our state-of-the-art technology then validates rates and detects/filters anomalies using algorithms, and averages all data collected over a 24-hour period to make it available to our customers.

As you can read, Oanda calculates average prices obtained from the world currency market and updated to the second.

In other words, Oanda’s business is to collect all the information on the rates at which global financial institutions and central banks buy and sell currencies and calculate the average rates at which those currencies are traded. And, of course, to sell this information to interested companies and institutions.

Currency converters offer wholesale prices

When you consult Oanda currency converter, keep in mind that the information it shows are wholesale exchange rates.

In other words, the exchange rates displayed by Oanda in its converter come from the foreign exchange market, which is a wholesale market.

This means that as a consumer you will never be able to access these exchange rates if you want to carry out a currency operation (transfer, currency exchange, money transfer, etc.).

And keep in mind that they give prices (exchange rates) to which large financial institutions exchange and operate with each other, not individuals who go on a trip abroad for tourism or work.

Only from Monday to Friday

Another thing to keep in mind when looking at the Oanda currency converter is that exchange rates between different currencies are calculated at all times, but only from Monday to Friday. On weekends, Friday prices are usually applied.

Therefore, the prices on the weekend will be those of the previous Friday.

Currency converters don’t work

Therefore, if you are an individual, you are going to pay other, worse prices (rates) when you do foreign exchange operations. Namely, that Oanda currency converter exchange rates are unrealistic.

Now, they give you an orientation of the exchange rates of the euro with respect to the other currencies of the world at all times.

And this information can be useful to calculate the value of a purchase on Amazon in another currency. Or for a contract.

In general, there are 3 different exchange rates that you will pay depending on the retail operation that you are going to carry out. From more interesting to less, are these 3 common operations that consumers carry out: currency transfers, money transfers (remittances) and currency exchange.

International currency transfers

An international transfer is a movement of money between two bank accounts expressed in two different currencies.

For example, if you want to make a payment to your child’s university in the United States, you will have to make a transfer from euro to dollar. You will go to your bank (or its website) and ask them to transfer euros to the dollar account of the American University. And the bank will apply the current euro to dollar exchange rate (plus some commission, probably).

This exchange rate will be somewhat worse than the Oanda Euro to Dollar exchange rate currency converter.

Money transfers

A money transfer is a movement of money between two countries, which is received by hand, in cash, in the currency of the destination country.

If you work in France and send money to a relative in Morocco, Algeria, Ecuador, etc., you go to a money transfer office in France, pay in cash or with a card in euros and the money transfer company makes available from your family member at destination the money, as if it were an ATM, in a local booth.

The exchange rate applied in this case is somewhat worse than that of international transfers. In other words, at destination they will receive fewer dollars for the same euros than if it were a transfer.

This is so because the money transfer company has to have a network of agents all over the world to which they have to pay a commission. The agent must have a place with adequate security so that your relative can obtain the local currency that you have sent him, in exchange, with your euros, from France.

Currency exchange

Finally, if what you want is to make a professional or tourist trip to another country with a currency other than the euro, you can take a bank card and also banknotes of that foreign currency to make cash payments at your destination.

In this case, you will go to a currency supplier or your bank, so that they can give you notes of that currency.

The exchange rate applied in this case is somewhat worse than that of international money transfers. In other words, you will receive fewer dollars for the same euros.

This is so because keeping a stock of banknotes of another currency has a risk of depreciation (exchange rate risk) in addition to logistics costs (sending dollars to another agency in the same city or in another city).

Summarizing

In short, the exchange rates you see on Oanda Currency Converter are wholesale and you will not be able to enjoy them as a consumer.

When looking for a currency exchange in Oanda, use them as a reference, but keep in mind that the exchange rates for transfers are worse than those in Oanda. And that if it is a money transfer or a currency exchange in a currency supplier, it will be even worse.

Sin comentarios